Articles & News

Market Report: Fewer new property listings entering the market

Published: 04.05.2017

If you have been waiting on a new batch of properties to come on the market at Lake Martin, this is your time of year. Every year during the months of February and March, we see a new batch of waterfront properties come on the market for sale. In fact, just in the last month, we have seen 60 new waterfront property listings come on the market—an 18.93% increase in just one month.

Now, you might think that sounds like a lot of new listings, but, compared to last year, we have 44 fewer properties on the market, which is a 10.45% decrease in available inventory. Available condo inventory is 32% lower and waterfront lot inventory is 25% lower compared to last year’s levels.

Sales Pace on Uptick

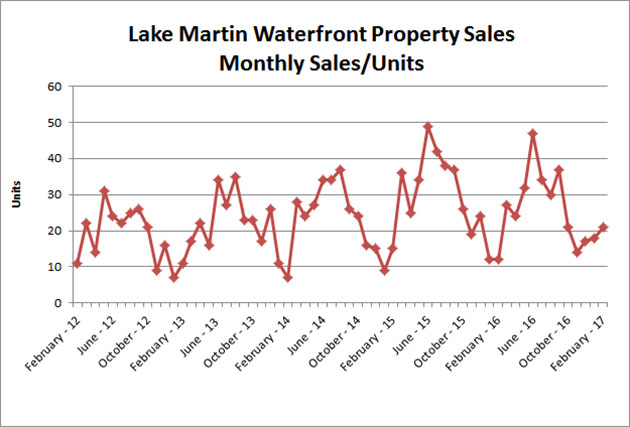

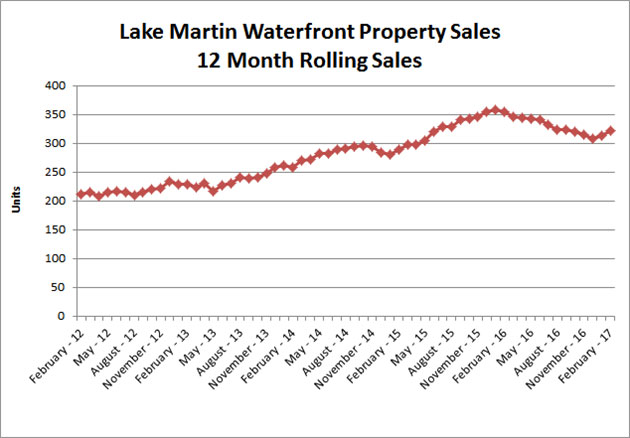

As expected with spring approaching, the sales pace picked up in February over January of this year, with an increase of 16.67% in the number of closed waterfront property sales. The increase over February a year ago was more dramatic with a 75% increase.

Negotiations Tighten

For the 12-month period ending in February 2016, the average list-price-to-sales-price ratio was 93.7% (Ex: If a property was listed for $1,000,000, you could expect to sell for $937,000). This year, the average list-price-to-sales-price ratio is 94.6%. Lower inventory levels will drive this ratio even higher as more buyers compete to purchase fewer properties. That is good news for anyone investing in a lake place.

This does not necessarily mean that values will shoot up significantly in the short term, but rather that buyers will realize a lower discount which will cause average prices to increase slightly. We expect the sales price ratio to approach 96% this summer, which will be a preview of higher average and median sales prices in the future.

Recommendations

For potential buyers, we suggest that you be active in looking for your Lake Martin home now through May as most properties come on the market in the spring. While it is tempting to bargain hunt, it is not likely that you will receive a big discount on properly priced properties. Your real estate professional should provide comparable sales info to aid you in preparing an offer. With so many recent transactions, you should be able to gauge a fair price.

For sellers, now is a good time to put your home on the market. Lake levels are rising early, and this winter has been mild. Potential buyers are out earlier than normal since many folks missed their chance to buy last summer. There are good comparable properties to use in preparing a fair list price. Avoid the temptation to pad the price beyond what the market will bear. Look for comps that have sold in the last 3-6 months. That is the current value. Making repairs and updating décor will usually reap a higher potential sales price and lower marketing time.

Stay informed. Our sales team keeps tabs on property availability, including what is likely to come on the market, as well as what is currently on the market. They can be reached at 256.215.7011 for current market information.